Sommeliers Choice Awards 2025 Winners

Breaking Barriers for Distillers: Alan Powell’s Influence on UK Spirits Regulation

Advocating change for independent distillers in the UK

Alan Powell is a key figure in the UK spirits industry, whose influence stretches over decades of legislative reform. As the founder and co-ordinator of the British Distillers Alliance (BDA), Powell has been at the forefront of shaping a more accessible and less restrictive environment for independent distillers. His journey from influencing critical regulatory changes while working with HM Customs & Excise (HMCE) to leading the BDA has enabled countless craft and start-up distilleries to navigate an otherwise complex and often prohibitive regulatory landscape. In this interview, Powell reflects on the groundbreaking policies he's championed, the challenges he’s faced, and the opportunities that lie ahead for the UK’s vibrant and rapidly growing spirits sector.

Alan, you’ve been instrumental in shaping legislation that supports the UK’s growing spirits industry. Could you elaborate on the key regulatory changes you've influenced and how they’ve opened doors for new distilleries?

Too much to state, but briefly, when in HMCE, I changed the law/policy in 1997 such that HMCE would consider issuing a distiller's license where the largest still would be less than 18 hl. This was both logical and to ensure that the HMCE did not act unlawfully in respect of their powers of discretion. I left HMCE end of 1997 but oddly my former colleagues seemed ignorant of that change for several years so continued to act unlawfully in declining applications. It is not even an issue now and small distillers are licensed without much trouble in this regard.

I devised the trade facility (TF) excise warehouse policy in about 1994 alongside the "GSD" policy to make warehousing simpler; in 2021, I compelled HMRC via initial litigation to remove the dwell time restriction on TF policy warehouses (which I would never have countenanced when I devised the policy) as well as the removal of a mandatory requirement for a premises guarantee for any excise warehouse. In 2015, I reached an agreement with HMRC's Deputy Director to give "approvals in principle" for distillers' licenses and excise warehouse keeper/warehouse approval to have some assurance of approval before committing finances.

The end of the W1 monthly warehouse stock return on a mandatory basis is on the cards - I had removed it when in HMCE in about 1996 since it was not consistent with systems-based control and officers just filed them away to no purpose. It had been brought back in 2002 (a few years after I left HMCE) as part of HMCE's cover-up and smearing of the industry to deflect blame from the singular honeypot criminal entrapment outward diversion fraud orchestrated by HMCE's National Investigation Service centered at London City Bond. This is a matter of public record. That fraud on the part of the NIS - to build prosecutions to boost HMCE's figures - was stopped dead in 1998. The revenue figures shot back up to "normal" immediately from 1998-99 to prove it was all artificial. But the collateral damage also lives on to this day in the spirit's duty stamps scheme and WOWGR and many businesses were, and are being, "thrown under the bus" in the cover-up - just like the Post Office sub-postmasters.

Image: A Bonded facility; Source: Linkedin

The British Distillers Alliance (BDA) has been working toward the abolition of the spirits duty stamps scheme. What does this policy shift mean for small and independent distillers, and what challenges did the duty stamps scheme present?

The intention to revoke the duty stamps scheme was announced in the March Budget but has not yet been abolished but it should still be on the cards under the new government administration.

I was outraged by the downright lies by HMCE about duty fraud in covering up the eponymous London City Bond fraud, especially when HMRC doubled down on this pack of lies in giving evidence before the Court of Appeal in 2019, so I started a challenge against duty stamps (and the registration of owners in excise warehouse under WOWGR) forcefully in 2019-20. I will not compromise on this and will litigate to expose the truth before the courts "from scratch" if it becomes necessary.

Both schemes had no legitimacy and breached the principle of proportionality. They are both unwarranted and egregious impositions and obstructions on business. For BDA members, apart from the cost of duty stamps, it is difficult to work within the law to reuse empty stamped bottles and for re-fills "off-site". Also utterly pointless!

Image Source: Revoke now duty stamp scheme! Written by Alan Powell (Distillers Journal)

BDA membership supports small and start-up distillers. What are the main challenges these new businesses face, and how does the BDA help them navigate the complex spirits industry landscape?

The current law and requirements are archaic and excessive and the process is unclear (and HMRC staff seldom fully understand it, sometimes barely at all). The BDA provides advice as to the correct process and what needs to be submitted that HMRC doesn't tell you! As noted earlier, we also kick obstacles out of the way that should not be there!

The upcoming law changes in March 2025 will impact distillers by removing the need for a license to distill or rectify spirits. How do you see these changes benefiting the industry, and what opportunities will they bring?

The licenses are a historic remnant and served no real purpose - you used to have to pay for them and have them renewed annually. Moreover, the changes next year are much broader and more fundamental than the removal of licenses.

There will be a single Alcohol Product Producer Approval (APPA) which will in effect be a simple "drinks factory" permit from HMCE to make any alcohol you want under one roof - or many roofs anywhere in the UK under a single APPA issued to the producer - (again something I tried to implement in HMCE thirty years ago). Spirits producers (“distillers”) may hold, mature, and carry out operations on the product under a single APPA. Optionally, distilled spirits may still be entered into the s92 CEMA warehousing (“bonded warehousing”) regime. Rectifiers and compounders will be moved from the excise warehousing regime in which they currently have to be approved into the “drinks factory” APPA approval. In summary under APED, all spirits producers will:

- Work in periods (monthly) to account for duty and benefit from;

- An average of 6 weeks’ duty deferred payment (“credit”) to HMRC; with

- No requirement for a duty deferment guarantee (required exceptionally for poor compliance/non-payment);

- Be able to “add” remote extra duty-suspended premises to main approved premises (permanent or temporary) – no “premises guarantee” is required as a standard condition of approval.

- Not have to submit monthly stock return W1;

- Have the option not to provide a movement guarantee for goods moved under duty suspension to other UK tax warehouses (“bonds” or other producers’ premises).

Things will be a lot easier and simpler and we have worked alongside HMRC to assist and enable this process. then I can retire!

[[relatedPurchasesItems-63]]

You’ve been at the forefront of the craft spirits movement for decades. Looking ahead, what do you believe will be the next significant milestone for the British spirits industry?

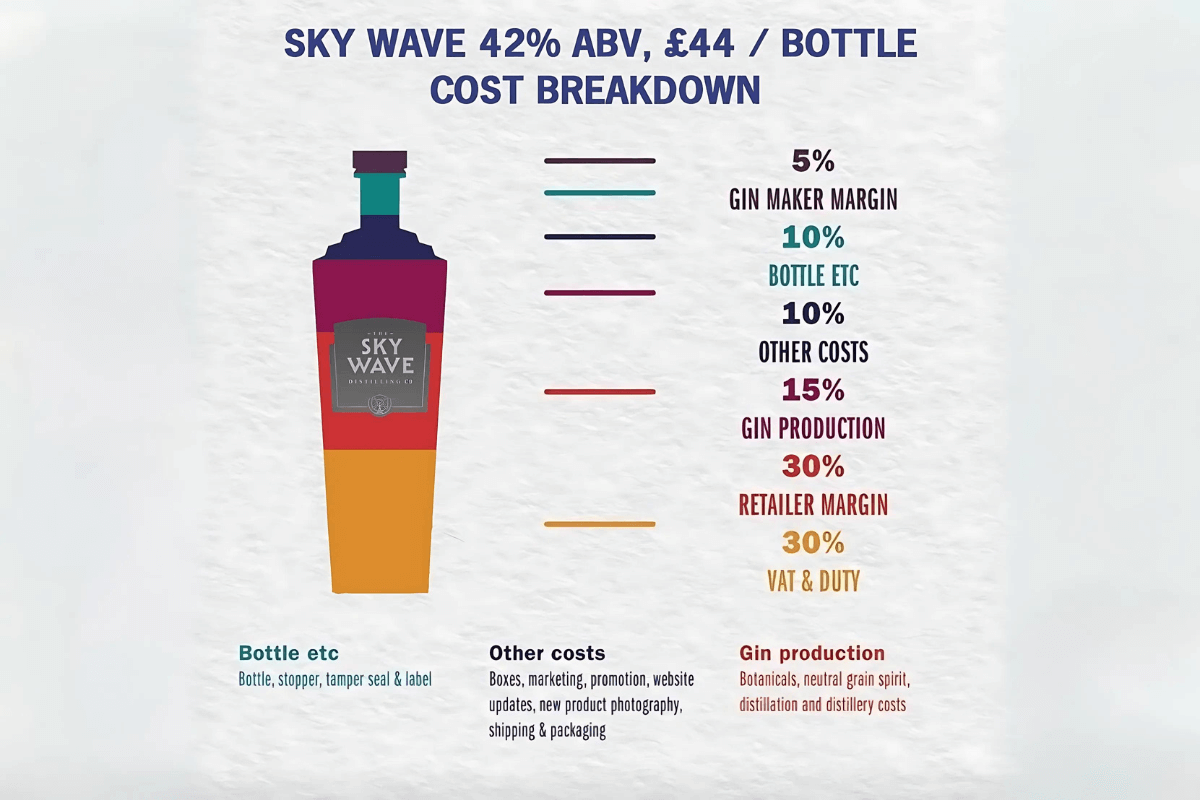

Apart from the difficulty in influencing Treasury and ministers on the high duty rate on products above 22% abv, we are lobbying for a reduced rate of duty for small producers (SMEs) for products above 8.4% abv. The current law discriminates against small spirits producers, especially with regard to the main full-strength products which have the most cachet but bear a very high rate of duty. We wrote recently to the new Treasury minister, James Murray to note that It is perverse that small brewers benefit from reduced rates of duty on their main products and have done so since Chancellor Gordon Brown announced such a scheme in the 2002 Budget, yet spirits SMEs must bear the burden of the full and highest alcohol duty rate on their main products. We acknowledge that at that time there was a provision in EU law for Member States benefit to small brewers, but this was not available to spirits producers to anything like the same extent. The UK may now make the same provision for reduced duty rates for all small alcohol producers, but the previous administration chose not to do so. This is especially galling when, as is commonly reported, BDA members often sell their main products at farmers’ markets alongside small cider makers who pay no duty and brewers who pay half the standard beer duty rate, but the small spirits producer pays the full rate, always. This is unfair in the extreme. We will request a meeting with Treasury staff to progress this matter.

Image Source: Alan Powell (LinkedIn post)

Conclusion:

Alan Powell’s work in the spirits industry has proven to be transformative, providing a foundation for new distilleries to emerge and ensuring that the sector remains innovative and competitive. As the UK continues to experience a boom in craft spirits, Powell’s legacy of simplifying regulations, advocating for fair treatment, and championing the needs of small producers will continue to help distillers in the UK. With upcoming changes on the horizon, such as the introduction of the Alcohol Product Producer Approval (APPA), Powell's influence will undoubtedly shape the next chapter of the UK spirits story, as he continues to clear the path of obstacles for distillers in the UK.

In conversation with Malvika Patel, Editor and VP, Beverage Trade Network

Also Read:

Pioneering Change: Claudia on Leading the UK Bartenders Guild as Its First Female President

Benjamin Brooks, Distiller at Bankhall Whiskey Distillery, England On His Role As A Distiller

Gin Trends for Bartenders in 2024-25: Insights from the 2024 London Spirits Competition