Sommeliers Choice Awards 2025 Winners

Insights from Lulie Halstead: Mastering Wine Marketing

Navigating Marketing Priorities and Consumer Insights in the Wine Industry

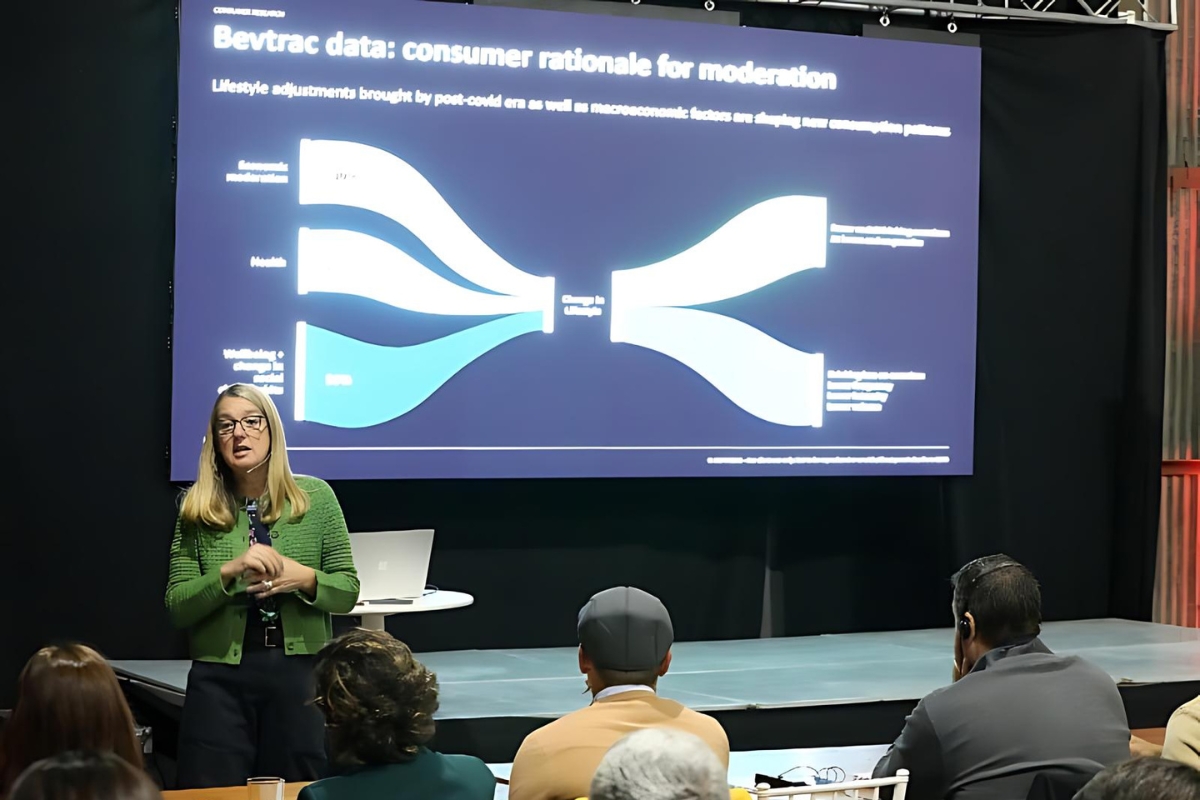

As the wine industry faces mounting challenges, from global competition to changing consumer tastes, the role of strategic marketing has never been more crucial. Lulie Halstead, an esteemed consultant and academic, emphasizes the importance of a market-oriented approach for wine businesses. Drawing on her extensive experience, including her leadership at IWSR and her work with Kitchingham Vineyards, Halstead discusses how wineries can effectively prioritize marketing to work toward future growth and profitability.

Lulie, in your interview with the Buyer, you mentioned the many challenges wineries face, so marketing is often “the last cab out of the rank!” Given the limitations that today’s wine businesses face, especially now that you have your own vineyard, how should they prioritize attention and budgets for marketing?

Wine businesses are typically product-oriented, which is of no surprise, given the complexities of wine production from viticulture to vinification. The history of wine as a commercial operation lies in small-scale agricultural production, where the wine produced was most typically sold if not to neighbors, then certainly in very local markets.

Wind the clock forward to the 20th century and wine finds itself competing in a global marketplace, increasingly competing with other beverage alcohol categories but also with no and low-alcohol beverages.

Given the declining volume of wine consumed globally, which based on forecasts from IWSR will be a 20% reduction in the volume of wine sold globally in the 10 years to 2028, we are at an inflection point for future wine business success.

From my 30-year perspective of working with and in wine businesses, it is more imperative than ever for wine businesses to shift their culture and strategy to become market-oriented to enable them to secure future business profitability and sustainability.

Market orientation is, at its core, a business strategy that prioritizes understanding who our consumers and customers are and, most importantly, what they value, and then aligning our products and brands around meeting the needs of these consumers and customers. Put simply customers are consumers who have to buy ‘our stuff’ and they will be more willing, likely, and able to buy our wines if they - from a liquid, branding, distribution, and pricing perspective - meet their needs and values.

Market orientation isn't only for the big guys and the multinationals. Market orientation is just as relevant for a small-scale wine business like mine (12 acres of Pinot Noir in the UK). I like many other small-scale wine producers, need to focus on who my target audience is, what types of wines engage and motivate them today and will continue to do in the future, and therefore what my branding, pricing, and distribution strategy must be to best meet their needs.

Image Source: Wine Intelligence

Can you share some examples of wine brands you think excel in marketing in this overcrowded market space?

There are many wine brands globally, from small-scale to multinational and from entry-level price points to luxury that excel in marketing.

Wente Vineyards (CA) family family-owned are operated business for example, is doing a fantastic job at engaging consumers directly, particularly LDA Gen Z and Millennial consumers. They have a clear market-oriented strategy and are investing time to really understand who their consumers are, what they value, and most importantly what they will pay for.

A very different example of two great wine brands are Yellow Tail (Australia) and Casillero del Diablo (Chile). These brands have consistently topped the ranking for many years in being ‘The most powerful wine brands in the world’ based on wine consumer feedback in 15 key consumption markets (source: IWSR / Wine Intelligence). These two brands have led with a clear focus on their consumers’ needs and, most importantly, both of these brands maintained their distinctive brand assets. That is, they have been relentlessly consistent with their design, packaging, positioning, and brand messaging. In both cases, these brands have moved through small design and packaging evolutions over the past 10 years to ensure that the brands remain fresh and relevant. However, what both brands have done is stand strong in terms of protecting their distinctive brand assets - their logos and designs - to ensure that they are driving up brand awareness, which we know from evidence at IWSR, is the key measure that correlates to brand growth.

Image Source: Yellow Tail and Casillero del Diablo

Where does IWSR come in, and how can wineries utilize information from this data to market their wines effectively?

Wine businesses can utilize data from IWSR to understand volume and value market data and forecast trends, not only for wine but also for all beverage alcohol and no & low beverages as well. It's imperative for wine businesses to have an understanding of not just wine, but also the TBA market. Additionally, IWSR publishes wine landscape reports that focus on key wine consumption markets globally. These reports provide tracking data across many measures to help wine businesses truly understand and navigate consumers within each of these key wine markets. IWSR also runs custom projects for wine businesses including brand health tracking or testing of new products, brands, labels, or advertising campaigns.

Can you tell us more about how you help global wine & spirits organizations create profit? Is it through the acute data and observations of market trends by IWSR, enabling companies to focus on categories more aligned with consumer behavior? Do you also help them with crafting or executing effective marketing strategies?

In my capacity as a non-executive director (independent director), interim leader, or through my advisory work, I work with the boards and leadership teams of wine and spirits businesses globally to support them in developing and executing their strategic growth plans. This can include working with a leadership team to ensure that consumers and customers are placed at the heart of the business or focusing on future market opportunities, product or brand development, distribution strategy, or pricing. I also sit on boards or provide board advisory input in a non-executive capacity, drawing on my experience in building businesses, specifically with beverage alcohol, particularly if the business is focused on exit or M&A.

These roles do utilize market data and information, such as that from IWSR, but my key role is to test, challenge and hopefully engage boards and leadership teams of wine and spirits businesses to ensure that they are on a successful path for future growth.

All of the businesses I work with I'm sure get quite sick of hearing me repeat ‘You are not your consumers. You don't behave like wine consumers. You are not normal when it comes to wine. You can’t be, because you are paid to work in wine’.

Image: Lulie Halstead spend 2 days in Porto with 80 of the team from across the Fladgate Partnership, focusing on business growth strategies - building on how to utilise market trends, consumer behaviour and behavioural economics for sustainable growth.

In a recent interview with Wines of Argentina, you mentioned that beers still dominate the no and low-alcohol space. How do wine and spirits compare in this category? What do you think of the quality of no and low-alcohol wines and spirits currently available in the market, and what is the scope given the production costs of de-alcoholization?

Beer certainly dominates the majority of the volume of the no and low alcohol space. Whilst we have seen ongoing improvements in the quality of low and no-alcohol wine, consumers' primary reason for not choosing low and no wine is based on negative taste perceptions or experiences.

When it comes to beer, which has a longer history of brewing low and no alcohol, the flavour profile is now excellent. Removing or reducing alcohol from 4 or 5% ABV to 0 or 2% ABV is a less impactful process on the flavour profile than removing alcohol in wine from 14% ABV.

Spirits are positioned differently, where typically a no or low alcohol spirit is mixed into a longer drink or cocktail, therefore the no or low alcohol spirit primarily provides one of a number of flavour components to the drink. This means that we see from consumers, less rejection of no or low-alcohol spirits based on their flavour profile.

Image: Lulie Halstead at the workshop, organized by Wines of Argentina; Source: Wine of Argentina.

Finally, on a Friday evening, what would we find you sipping on, and what music would you be listening to?

It depends on where I am on a Friday night and what time of year it is as to what I'll be drinking. If I'm at home in the UK, you might find me in a pub drinking Radler - known as shandy in the UK – which is beer and lemonade mixed. Or it might be a glass of rosé wine and yes, you will find my glass of rosé typically filled with many ice cubes!

However, my go-to drink of choice has for many years been Chardonnay – big, full buttery, and oaky.

As for music, whatever playlist I’m listening to, will always contain a significant amount of The Killers.

[[relatedPurchasesItems-38]]

Conclusion:

Lulie Halstead's insights highlight the imperative for wine businesses to shift from a purely product-focused approach to a market-oriented strategy. By understanding and meeting consumer needs, wineries can navigate the complexities of today's market and secure long-term success. Whether through data-driven decisions, innovative branding, or strategic pricing, the path to profitability in the wine industry is clear: embrace the consumer at every turn.

In conversation with Malvika Patel, Editor and VP, Beverage Trade Network